For homeowners, foreclosure can be stressful and worrisome, especially those trying to sell their homes. The foreclosure process can be complicated and confusing and impact the real estate market in Jacksonville, FL. But, understanding the process and taking the proper steps can help homeowners protect their interests and avoid financial loss. This article will guide home sellers navigating the foreclosure process in Jacksonville, FL.

The Impact of Foreclosures on the Jacksonville, FL Real Estate Market for Sellers

Foreclosures can impact the real estate market in Jacksonville, FL. When a home goes into foreclosure, it often sells for less than its market value, which can drive down home prices in the surrounding area. This can make it more difficult for homeowners to sell their homes for a fair price. Additionally, foreclosures can lead to a high supply of homes on the market, making it more challenging for home sellers to find buyers.

Despite these challenges, it is still possible for homeowners to sell their homes during foreclosure. By understanding the current market state and taking steps to protect their interests, homeowners can cut the impact of foreclosure on the sale of their homes.

Check out this article to know the future of the US housing market in 2023.

Understanding the Foreclosure Process in Jacksonville, FL

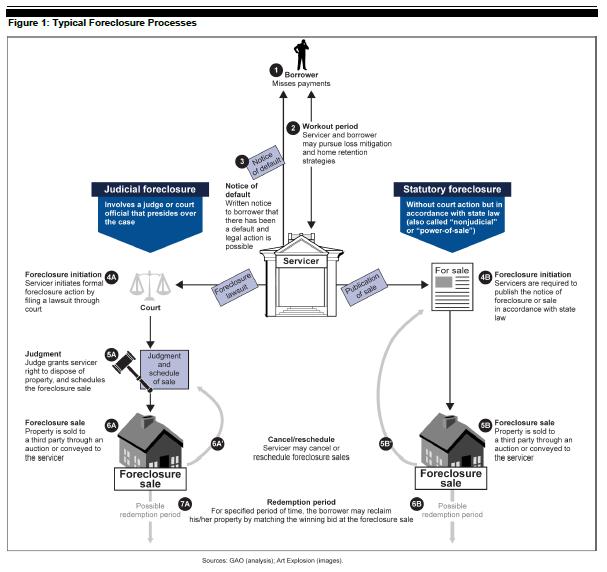

The foreclosure process in Jacksonville, FL, begins when a homeowner falls behind on their mortgage payments. The lender will then send a notice of default, giving the homeowner time to keep their payments current. This notice of default warns homeowners that they are in danger of foreclosure and must take action to avoid it. The lender will begin foreclosure if the homeowner cannot make their current payments within the specified time frame.

During the foreclosure process, the lender will file a complaint with the court, and a foreclosure notice will be served to the homeowner. The homeowner will then have the opportunity to respond to the complaint and raise any defenses they may have. This includes the right to a fair and accurate accounting of the amount owed on the mortgage and the right to challenge any errors in the foreclosure process.

If the homeowner cannot stop the foreclosure, the lender can sell the property at a public auction. The proceeds from the sale will be used to pay off the outstanding mortgage debt and any other fees associated with the foreclosure. If the sale proceeds are insufficient to cover the debt, the homeowner may be held responsible for the remaining balance.

Homeowners have rights during the foreclosure process, including the right to a fair and accurate accounting of the amount owed on the mortgage and the right to challenge any errors in the foreclosure process. Homeowners should also consider alternative options for avoiding foreclosure, such as short sales or loan modifications.

Avoiding Foreclosure in Jacksonville, FL: Alternative Options for Home Sellers

Homeowners facing foreclosure in Jacksonville, FL, have several alternative options to explore to avoid losing their homes. One of the most popular options is a short sale. A short sale is when a homeowner agrees to sell their home for less than the outstanding mortgage debt. This can be a good option for homeowners who cannot bring their payments current but still want to avoid foreclosure.

Another option for homeowners is loan modification. A loan modification is when a lender agrees to change the terms of a mortgage, such as the interest rate or the length of the loan, to make it more affordable for the homeowner. This can be a good option for homeowners facing temporary financial difficulties who still want to keep their homes.

Furthermore, the homeowner should also consider working with an experienced real estate agent. A professional real estate agent can help homeowners navigate foreclosure and sell their homes for the best possible price. This can help homeowners avoid financial loss and move on to a brighter future.

Homeowners should also be aware of the resources available, such as government programs and non-profit organizations that can provide help and guidance. These organizations can help homeowners understand their rights and explore alternative options for avoiding foreclosure.

Conclusion

Foreclosure can be daunting and stressful for homeowners, especially those trying to sell their homes. But, homeowners can protect their interests and avoid financial loss by understanding the foreclosure process and taking the proper steps. By communicating with their lender, hiring an attorney, and considering alternative options such as short sales or loan modifications, homeowners can cut the impact of foreclosure on the sale of their homes.

Additionally, homeowners can still sell their homes during foreclosure by being prepared to sell them for less than market value and working with an experienced real estate agent. Knowing the resources available for homeowners facing foreclosure in Jacksonville, FL, such as government programs and non-profit organizations that can provide help and guidance, is essential. Remember, do not hesitate to seek help from professionals and experts in the field, as they can help you navigate the complex foreclosure process.

What you should do?

If you’re a homeowner facing foreclosure in Jacksonville, FL, you must understand that you have options. Whether it be a short sale, loan modification, or working with a real estate agent, you can still sell your home and move on to a brighter future. Remember, the key is to take action as soon as possible and not hesitate to seek help from professionals and experts.

If you’re looking for professional and experienced help navigating the foreclosure process in Jacksonville, FL, consider contacting ALKO Home Buyers. We have worked with homeowners experiencing this situation, and working with us has been the best decision they made. We buy houses in Jacksonville, FL, and surrounding areas for a while now. Our team of experts is dedicated to helping you find the best solution for your situation and sell your home. Please don’t wait any longer. Contact us today and let us help you navigate the foreclosure process and find a solution that works best.

Frequently Asked Questions

The foreclosure process in Jacksonville, FL is when a lender takes possession of a property due to the homeowner’s inability to make mortgage payments. The process begins with the lender issuing a notice of default and can ultimately lead to a public auction of the property.

There are several ways to avoid foreclosure in Jacksonville, FL, such as:

- Seeking help from a housing counselor or non-profit organization

- Applying for a loan modification or refinancing

- Selling the property through a short sale

- Working with a real estate agent to sell the property

A short sale is when a homeowner sells their property for less than the outstanding mortgage balance. This type of sale is often used as an alternative to foreclosure because it allows the homeowner to sell their property and avoid the negative impact of a foreclosure on their credit.

The consequences of a foreclosure in Jacksonville, FL can include a negative impact on your credit score, difficulty in obtaining future mortgages or loans, and the potential loss of your property.

The length of the foreclosure process can vary depending on the specific circumstances of the case. However, on average, it can take several months to a year for the process to be completed.

Yes, it is possible to sell your house during the foreclosure process in Jacksonville, FL. One option is to work with a real estate agent to sell the property. Another option is to apply for a short sale, where the property is sold for less than the outstanding mortgage balance.

- Quickly Sell Your Home for Cash in Jacksonville, FL - April 12, 2024

- How to Stop Foreclosure with Expert Help in Jacksonville, FL - January 28, 2024

- Homeowners Guide to Foreclosure Prevention in Jacksonville, FL - January 27, 2024